CMS 588 EFT Form Instructions - JE Part A

CMS 588 EFT Form Instructions

Electronic Funds Transfer (EFT) deposits your Medicare payments directly into your bank account. CMS requires all providers that are enrolling in Medicare Part A, revalidating, or when the EIN, pay-to address or LBN to their file is being changed, must complete the EFT. Complete the form and have it signed and dated by the provider or authorized/delegated official (for groups or organizations). The signature must be original with a date (cannot be a copy or stamped signature). To sign up, complete an Electronic Funds Transfer Authorization Agreement - CMS 588.

A group does not need to submit an EFT form for each of its members. Return the form to the address listed for your state, found on the Provider Enrollment Contacts page.

CMS 588 EFT Form Instructions

We cannot alter CMS' instructions, but we received permission to add additional comments/instructions, which we have indicated with italicized text.

| Sections of the EFT Application | Description |

|---|---|

| Part I: Reason for Submission |

Indicate the reason for completing the form:

If you are authorizing EFT payments to a Chain Home Office:

|

| Part II: Provider/Supplier Legal Business Name |

Enter the provider/supplier's legal business name as reported to the IRS:

|

| Part II: Chain Organization or Home Office Legal Business Name |

Enter the chain organization's name or home office legal business name (if different from the chain organization's name) Do not list the enrollee's Doing Business as Name (DBA) in in this field. Note: If the provider is not a member of a chain organization, the account to which the payments are made must exclusively bear the name of the physician, individual practitioner, or legal business name of the person or entity enrolled in Medicare. For more information on Chain Organizations, please see IOM Pub 100-08, Chapter 10, Sections 10.3.1 and 10.3.3.1.E.7 |

| Part II: Account Holder's Street Address, City, State, and Zip Code |

Enter the account holder's physical street address, city, state, and zip code. This cannot be a PO Box. |

| Part II: Tax Identification Number |

Enter the tax identification number as reported to the IRS.

|

| Part II: Medicare Identification Number (also called PTAN) |

Enter the Medicare Identification Number assigned by the contractor, if one has been issued. This is also referred to as a provider enrollment access number (PTAN). If you are not yet enrolled in Medicare, this box can be left blank. |

| Part II: National Provider Identifier (NPI) |

Enter the 10 digit NPI number.

|

| Part III: Financial Institution Name |

Enter the Financial Institution's Name (bank or other qualifying depository) to where the funds will be deposited. Note: The account number to which the EFT payments will be made, must bear the name of the individual or entity enrolling/enrolled, as indicated in Part II of this form. |

| Part III: Financial Institutions Street Address, City, State, and Zip Code |

Enter the financial institution's physical address (cannot be a PO Box), city, state, and zip code. |

| Part III: Depository Telephone Number |

Enter the telephone number for the bank/financial institution. |

| Part III: Financial Institution's Contact Person |

Enter the name of the contact person at the bank/financial institution, who will be able to answer questions Medicare may have regarding the account or set-up of the account. This should not be the contact person for the enrollee, but rather a representative from the bank itself. |

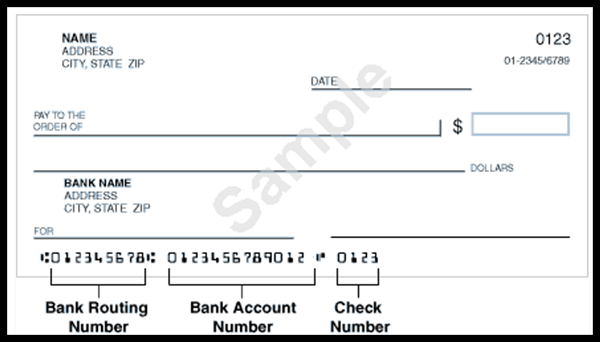

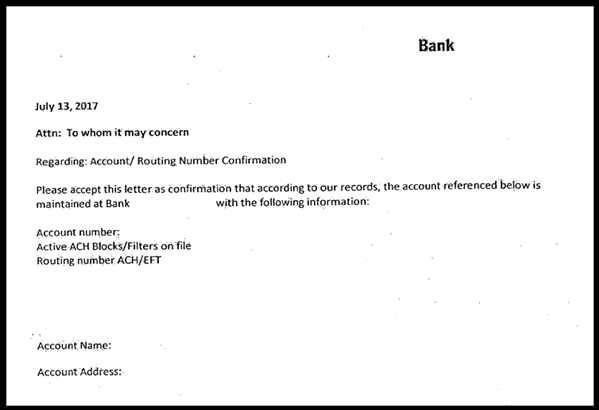

| Part III: Depository Routing Transit Number |

Enter the bank/financial institution's nine-digit routing number, including applicable leading zeros. This must match exactly as found on the voided check or bank letter. The routing number cannot begin with a 5. The routing number is usually located in the bottom left corner of the provider/group's check. |

| Part III: Depositor Account Number |

Enter the depositor's account number including applicable leading zeros. This must match exactly as found on the voided check or bank letter. Note: The check number may be within the account on the bottom of check. Please do not include the check # on the EFT form. |

| Part III: Type of Account |

Check the account type (checking or savings) that the EFT payments should be deposited in. |

| Part IV: Contact Person Information |

Enter the contact person's name, title, telephone number, and email address (if applicable) who is responsible for answering questions about the information submitted on the EFT form. |

| Part V: Authorization |

By signing this form you are certifying that the account is drawn in the Name of the Physician or Individual Practitioner, or the Legal Business Name of the Provider or Supplier. The Provider or Supplier has sole control of the account to which EFT deposits are made in accordance with all applicable Medicare regulations and instructions. All arrangements between the financial institution and the said Provider or Supplier are in accordance with all applicable Medicare regulations and instructions with the effective date of the EFT authorization. You must notify the Medicare contractor regarding any changes to the account in sufficient time for the contractor and the depository to act on the changes. The EFT authorization form must be signed and dated by the same Authorized Representative or a Delegated Official named on the CMS-855 Medicare enrollment application which the Medicare contractor has on file. Include a telephone number where the Authorized Representative or Delegated Official can be contacted. Mail this form with the original signature in black or blue ink (no copied or stamped signatures can be accepted) to the Medicare contractor that services your geographical area. The date the form is signed also needs to be included in order for the signature to be accepted. An EFT authorization form must be submitted for each Medicare contractor to whom you submit claims for Medicare payment. |

| Supporting Documentation: The documents need to be included with the EFT when it is mailed in order to process the EFT application in a timely manner. |

|