Provider Based Facilities - JF Part A

Provider Based Facilities

Provider-based clinics are owned and operated by single entities referred to as "main providers." The clinics may be on the same campus as the main provider, or located off-campus.

On this page, view information about the below.

- Electronic Submission of Provider Based Attestations and Mid-Build Certifications

- Attestations

- Criteria

- Obligations

- Practice Location Address Requirements

- Physician Supervision

- Billing

- Medicare Secondary Payer (MSP)

Electronic Submission of Provider Based Attestations and Mid-Build Certifications

Noridian accepts the submission of provider based attestations and mid-build certifications electronically. Provider based attestation and mid-build certifications should be sent to providerbasedattestations@noridian.com.

Attestations

Providers are not required to receive a provider-based determination for their locations prior to billing for services in those facilities as provider-based. Providers may obtain a determination of provider-based status by submitting an attestation stating that the facility meets the relevant provider-based requirements for on-campus or off-campus locations. Providers who wish to obtain the determination for their facilities should do so through the self-attestation process.

Sample attestation and needed content can be found in Program Memorandum A-03-030, published April 18, 2003. File the attestation with the A/B MAC, and send a copy to CMS Regional Office for state in which the facility is located.

Upon approval of the attestation, the clinic will be designated as provider-based.

When the facility self-attests and CMS subsequently determines that the clinic does not meet provider-based rules, the Medicare Administrative Contractor (MAC) will recoup payments as necessary. CMS will estimate the appropriate payment in absence of compliance with provider-based rules. The amount recouped will equal the difference between the payments made from the attestation filing date and the correct payment amount estimated by CMS. If the clinic does not have a provider-based designation, all past provider-based payments will be recouped for all cost reporting periods subject to reopening.

When a facility with a CMS approved provider-based status is found to no longer meet the provider-based rules; the facility will not be held liable for any potential overpayments. CMS will work with the MAC and facility to notify both the provider-based status is no longer valid.

Criteria

Before a main provider may bill for services of a clinic as if the facility is provider-based, or before it includes costs of those services on its cost report, the facility must meet the criteria listed in the regulations. The following is an overview of the criteria; additional provisions apply to off-campus locations and joint venture entities (see Program Memorandum A-03-030).

- Licensure

- Clinic must operate under same license as the main provider, unless the state requires a separate license

- Clinical Services

- Professional staff have clinical privileges at main provider

- Main provider maintains same monitoring and oversight as for other departments

- Clinic medical director has same reporting relationship/procedures to main provider as other departments

- Medical staff/other professional committees at main provider are responsible for medical activities in the clinic including Quality Assurance (QA), Utilization Review (UR) and coordination and integration of services

- Medical records are integrated into unified retrieval system or cross referenced

- Inpatient and outpatient services are integrated

- Financial Integration

- Financial Operations are fully integrated within the financial system of main provider, included in main provider's cost report

- Public Awareness

- Clinic is held out to the public and other payers as part of main provider

Obligations

A provider-based clinic must fulfill the obligations of a hospital outpatient department:

- Must comply with anti-dumping rules

- Physician services (other than Rural Healthcare Clinics (RHC)) must be billed with correct site-of-service so appropriate professional payment amount is determined

- Must comply with all terms of hospital's provider agreement

- Physicians must comply with anti-discrimination provisions

- Must treat all Medicare patients, for billing purposes, as hospital outpatients.

- Clinic patients subsequently admitted to hospital are subject to same pre-admission bundling provisions as apply to other hospital outpatient services

- Pre-admission bundling does not apply to Critical Access Hospital (CAH)-based clinics

- Must meet applicable health and safety rules

Practice Location Address Requirements

CMS has requirements for provider-based organizations that increase the accuracy of claims billed for their services rendered in off-campus, outpatient locations (those located farther than 250 yards from the main campus, up to 35 miles). On-campus services are not affected by these requirements.

There are two components to the off-campus, outpatient services that have separate requirements.

Address Match: The address billed on the claim for the rendering provider must be an exact match to the address of that location listed in the Provider Enrollment Chain and Ownership System (PECOS). This exact match is related to alphanumeric characters, spaces, and punctuation; not capitalization.

For additional information on how to report the addresses on claims on the UB-04, in the Direct Data Entry (DDE) system, or in the 837i transaction, see CMS Medicare Learning Network (MLN) Matters Special Edition (SE) 19007.

Claim Lines: Each line on the claim must contain either the PO or the PN modifier:

- PO: Excepted services, procedures and/or surgeries provided at off-campus provider-based outpatient departments of a hospital

- PN: Nonexcepted items and services provided at off-campus provider-based outpatient departments of a hospital

- ER: Items and services furnished by a provider-based off-campus emergency department

The PO and PN modifiers are not to be used for on-campus departments, or dedicated emergency departments. For more information on the ER modifier requirement for provider-based, off-campus dedicated emergency departments, see CMS CR 11099.

For more information on the ER modifier requirement for provider-based, off-campus dedicated emergency departments, see CMS CR 11099.

For additional information on how to bill claims with the PO and PN modifiers, see the Off-Campus Hospital Outpatient Department Reporting Requirements.

Physician Supervision

- Diagnostic Services - Prospective Payment System (PPS) facilities should follow the supervision requirements for individual tests as specified in the Medicare Physician Fee Schedule.

- On-Campus outpatient department

- Physician must be present on the same campus and immediately available to furnish assistance and direction throughout the performance of the procedure

- Off-Campus outpatient department

- Physician must be present in the off-campus provider-based department of the hospital and immediately available to furnish assistance and direction throughout the performance of the procedure.

- On-Campus outpatient department

- Therapeutic Services - The supervision requirements for therapeutic services apply to both PPS and CAH facilities.

- On-Campus outpatient department

- Physician must be present on the same campus and immediately available to furnish assistance and direction throughout the performance of the procedure

- Off-Campus outpatient department

- Physician must be present in the off-campus provider-based department of the hospital and immediately available to furnish assistance and direction throughout the performance of the procedure.

- On-Campus outpatient department

Billing

Provider-based clinics must treat all Medicare patients as hospital outpatients for billing purposes:

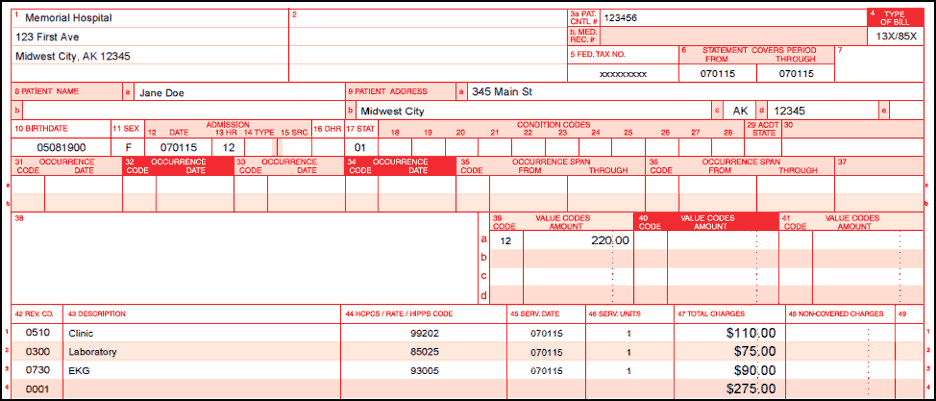

- UB-04 Requirements

- Type of bill (TOB) 13X or 85X

- Append appropriate HCPCS, subject to correct coding initiative (CCI) edits

- Effective January 1, 2016, modifier PO must be appended to all items and services paid under Outpatient Prospective Payment System (OPPS) rendered in an off-campus outpatient department

- Effective January 1, 2017, modifier PN must be appended to all items and services paid under Medicare Physician Fee Schedule (MPFS) rendered in an off-campus outpatient department

- Include professional services for clinics based within a CAH Method II

- Line item dates of service

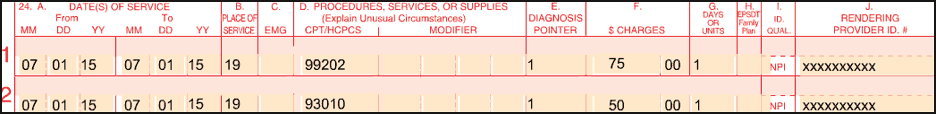

- CMS-1500 Claim Form Requirements

- Bill professional services

- Include place of service (POS) 19 when the service are rendered in an off-campus outpatient department

- Include POS 22 when the services are rendered in an on-campus outpatient department

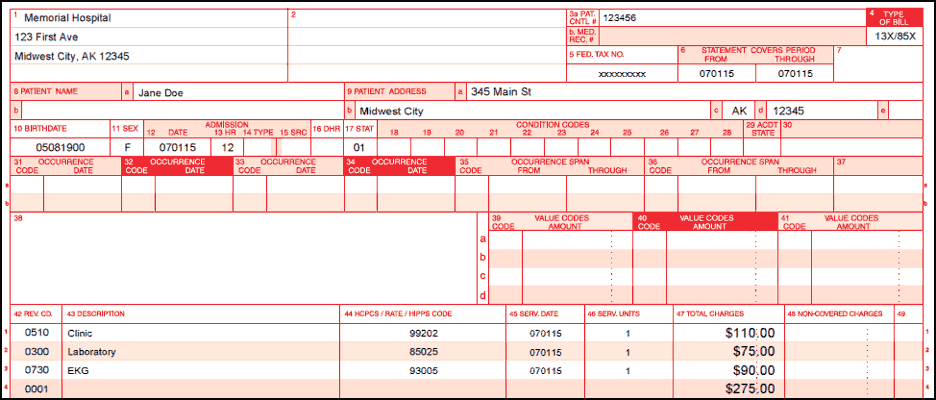

Billing Example One - PPS Hospital/ Method I CAH On-campus

- UB04 shows facility charges

- CMS-1500 claim form contains professional component for 99202 and electrocardiogram (EKG) reading fee (93010), billed with place of service 22 to indicate outpatient hospital services were rendered in the on-campus location

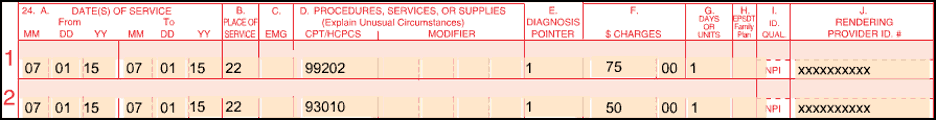

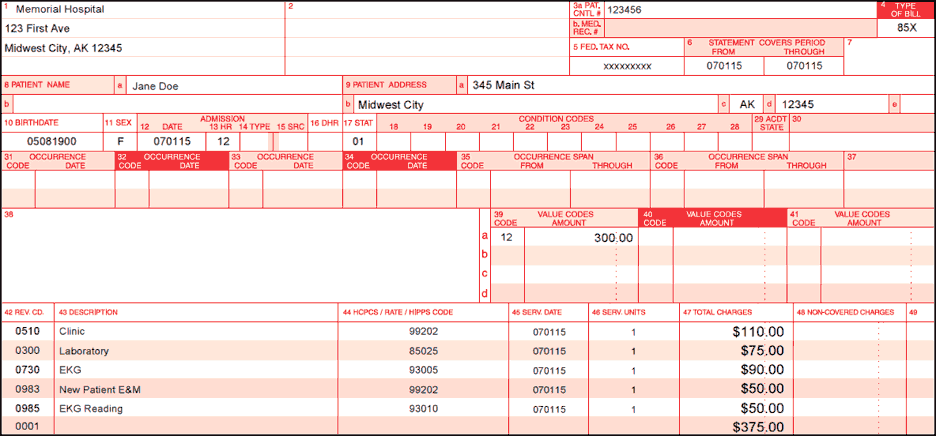

Billing Example Two - Method II CAH On-campus

- Professional services included on UB-04

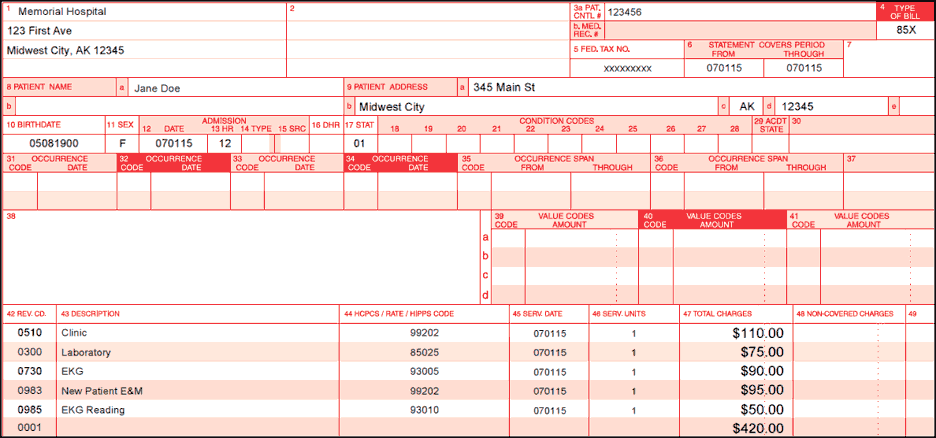

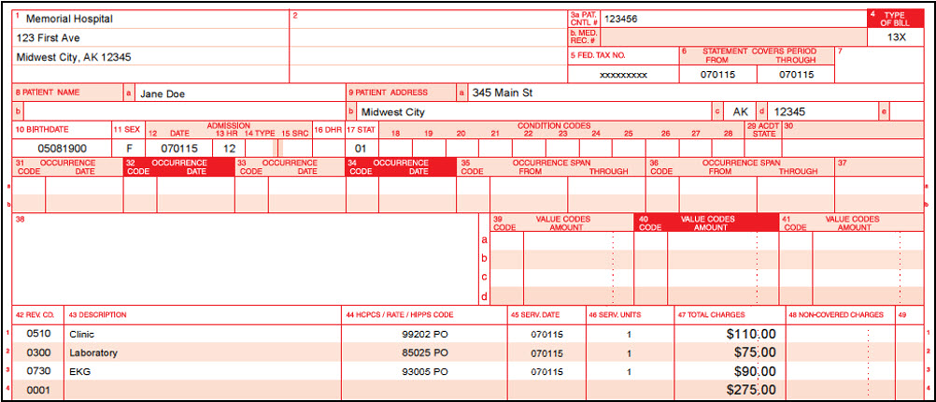

Billing Example Three - PPS Hospital Off-campus

- UB04 shows facility charges with PO modifier

- CMS-1500 claim form contains professional component for 99202 and Electrocardiogram (EKG) reading fee (93010), billed with place of service 19 to indicate outpatient hospital service in an off-campus location

Medicare Secondary Payer (MSP)

As stated above, provider-based clinics must treat all Medicare patients as hospital outpatients for billing purposes. Patients who have an insurer primary to Medicare cannot be treated as physician office patients, even if the primary payer does not treat the clinic visit as if it were a hospital service.

MSP PPS/Method I CAH

When a primary payer makes separate payments for technical and professional services, those payments are reported on the corresponding UB-04 and the CMS-1500 claim forms submitted to Medicare.

When a primary payer makes a combined payment for clinic services, that payment must be prorated between technical and professional services.

Example:

- Total Charges = $375

- Facility Component = $275

- Professional Component = $100

- Primary Payment = $300

- 80% (Primary Payment divided by Total Charges) = $300 divided by $375 = 80%

- MSP amount reported on UB04 (Facility Component multiplied by 80% verbiage) = $220 ($275 x 80%)

MSP Method II CAH

When a primary payer makes combined payment, report the amount of the total payment with the appropriate value code on the UB-04.

When a primary payer makes separate technical and professional payments, combine the payments and report under the total with the appropriate value code on the UB-04.

Example:

- Total Charges = $375

- Facility Component = $275

- Professional Component = $100

- Primary Payment for Facility Component = $220

- Primary Payment for Professional Component = $80

- MSP reported amount = $300

Resources

- CMS Change Request (CR) 9231

- CMS Internet-Only Manual (IOM), Publication 100-04, Medicare Claims Processing Manual, Chapter 1, Section 170.1.1 – Payments on the MPFS for Providers With Multiple Service Locations

- CMS Internet Only Manual (IOM), Publication 100-04, Medicare Claims Processing Manual, Chapter 4, Section 20.6.6.11

- CMS Internet Only Manual (IOM), Publication 100-05, Medicare Secondary Payer Manual

- CMS Change Request (CR) 9613

- CMS CR 11099 - January 2019 Update of the Hospital Outpatient Prospective Payment System (OPPS)

- CMS Program Memorandum A-03-030

- CMS Medicare Learning Network (MLN) Special Edition (SE)19007 - Activation of Validation Edits for Providers with Multiple Service Locations

- 42 CFR 413.65 (d) (e) - Federal Register Provider-Based Definitions