CAH MIPS Calculation Guide - JF Part A

CAH MIPS Calculation Guide

The Medicare Merit Based Incentive Payment System (MIPS) combines three legacy programs, the Medicare Electronic Health Record (EHR) Incentive Program; Physician Quality Reporting System (PQRS); and the Value-based Payment Modifier (VM); into one single, improved program.

Under MIPS, there are four performance categories. Each performance category is scored by itself and has a specific weight that contributes to the MIPS Final Score.

- Quality - measures health care processes, outcomes, and patient experiences of their care

- Providers select the quality measures that are most appropriate for their practice and patient population

- Cost - measures assess beneficiary's total cost of care during the year, or during a hospital stay, and/or during 8 episodes of care

- Improvement Activities - performance category measures participation in activities that improve clinical practice

- Most groups must submit between two and four activities, each performed for a minimum of a continuous 90-day period in 2019

- Small practices (15 or fewer clinicians) or providers in a rural or health professional shortage area must submit one or two activities for a minimum of a continuous 90-day period in 2019

- Promoting Interoperability - measures resources clinicians use to care for patients and Medicare payments made for care (items and services) provided to beneficiaries

- Providers promotes patient engagement and the electronic exchange of health information using certified EHR technology (CEHRT)

CAH Method II Payment

How to identify payment adjustment at the claim and service level?

- Group code = CO (Contractual Obligation)

- Required by Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) bipartisan law

- Indicates both positive and negative adjustment

- Claim Adjustment Reason Code (CARC) = 144

- Shows positive incentive adjustment

- CARC = 237

- Shows a negative incentive adjustment

- CARC N807

- Part B remittance advice shows a negative; system processes MIPS adjustment by each physician

- Payment made based on MIPS

How is the payment adjustment calculated?

- Medicare Physician Fee Schedule amount - (co-insurance/deductible 20%)

- Amount from line 1 multiply by provider reimbursement rate

- Amount from line 2 minus 2% sequestration deduction

- Value from line 3 is applied as increase (bonus) or decrease (reduction) in payment

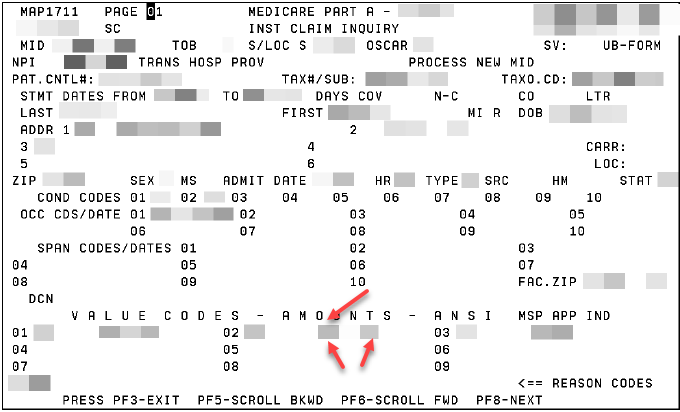

Locate QPP Payment - Part A

Where to find the payment amount on the Part A claim.

- Map1711 in Direct Data Entry (DDE) - Page 01 under value code amounts

- Two red arrow point to monetary amount at line level on claim page

- Single red arrow points to the Group Code CO and CARC code (either 144 or 237)

See the Quality Payment Program webpage for details.