Respond to a Demand Letter - JF Part B

Respond to Demand Letters

When Medicare has determined that an overpayment exists, a receivable account will be established and a Demand Letter will be issued. To avoid interest from accruing, timely payment is critical. The provider is given 30 days from the date of the Demand Letter to pay the requested overpayment amount. If payment is not received timely, interest will accrue.

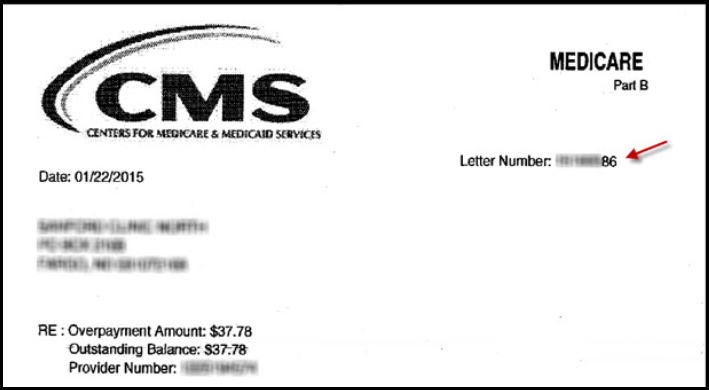

The Demand Letter includes detailed information necessary to satisfy the overpayment and information on how to submit an appeal if there is disagreement with the overpayment. The Demand Letter will also be assigned a Letter Number which is used to identify what has been demanded by Medicare.

View below Demand Letter example.

Two Options for Satisfying Demanded Overpayment

- Send in a check along with a copy of Demand Letter: Address where to mail check and copy of Demand Letter is also located on Demand Letter

- Request Immediate Recoupment

Overpayments and Next Steps

When an overpayment has occurred, a Demand Letter is issued. When a demand letter is received, providers have the following options:

Agree with the Overpayment:

- Send Noridian a check for the owed money

- Request an Immediate Offset

Disagree with the Overpayment

- Submit a Rebuttal if the overpayment action will cause financial hardship (A rebuttal will not stop the recoupment activities)

- Submit a Redetermination Request