Bad Debt - JE Part A

Bad Debt

A provider's bad debts resulting from Medicare deductible and coinsurance amounts that are uncollectible from Medicare beneficiaries are considered in the program's calculation of reimbursement to the provider if they meet the criteria specified in 42 CFR 413.89 and Provider Reimbursement Manual (PRM) 15-1, Chapter 3, Section 306-324.

Per 42 CFR 413.89(e), a bad debt must meet the following criteria to be allowable:

- The debt must be related to covered services and derived from deductible and coinsurance amounts.

- The provider must be able to establish that reasonable collection efforts were made.

- The debt was actually uncollectible when claimed as worthless.

- Sound business judgment established that there was no likelihood of recovery at any time in the future.

Additionally, the professional component of a provider-based physician remuneration is not recognized as an allowable bad debt in the event the provider is unable to collect the charges for the professional services of such physicians. (PRM-I, Chapter 3, Section 324)

Effective for cost reporting periods beginning on or after October 1, 2018, a cost report will be rejected when submitted without listings that correspond to the amount of bad debt claimed (42 CFR 413.24(f)(5)). If applicable, submit separate exhibits for each provider number in a hospital health care complex.

Dual Eligible Bad Debts

Dual eligible bad debts are from persons who qualify for both Medicare and Medicaid coverage. Medicare covers their acute care services, while Medicaid covers Medicare premiums and cost sharing and long term care services. Medicare beneficiaries can qualify for Medicaid if they meet certain income and resource requirements or have high healthcare bills. Each state has its own eligibility standards and determines the scope of benefits provided to Medicaid beneficiaries, within federal guidelines.

With respect to "dual-eligibles", states are allowed to limit that amount to the Medicaid rate and essentially pay nothing toward dual eligibles' cost sharing if the Medicaid rate is lower than what Medicare would pay for the service. In those instances where the state owes none or only a portion of the dual-eligible patient's deductible or co-payment, the unpaid liability for the bad debt is not reimbursable to the provider by Medicare until the provider bills the State and the State refuses payment (with a State Remittance Advice). Even if the State Plan Amendment limits the liability to the Medicare rate, by billing the State a provider can verify the current dual-eligible status of a beneficiary and can determine whether or not the State is liable for any portion thereof.

What to submit

CMS 222-17, 2088-17, 224-14, 265-11, 2540-10

The provider should submit Exhibit 1, the Medicare Bad Debt RHC, CMHC, FQHC, ESRD, SNF template. Please see the cost reporting instructions appropriate for the Medicare Cost Report you will be completing for instructions on how to complete Exhibit 1. To expedite the review process, the provider may also want to consider submitting the state Medicaid remittance advices showing each uncollected co-insurance and deductible amount.

CMS 1728-20

The provider should submit Exhibit 1, the Medicare Bad Debt 1728-20 (HHA) Template. Please see PRM 15-2, Chapter 46-(T5) for instructions regarding completion of Exhibit 1. To expedite the review process, the provider may also want to consider submitting the state Medicaid remittance advices showing each uncollected co-insurance and deductible amount.

CMS 2552-10

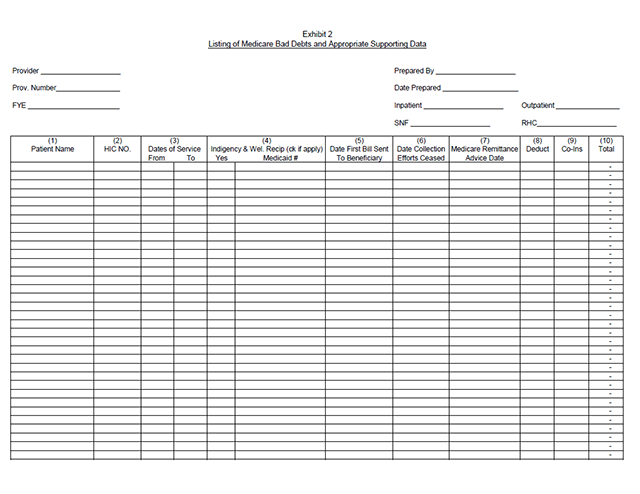

Cost Reporting Periods Prior to October 1, 2022

The provider should submit the Exhibit 2, Bad Debt Listing, with the cost report. In order to expedite the review process, the provider may also want to consider submitting the state Medicaid remittance advices showing each uncollected co-insurance and deductible amount.

Exhibit 2

Columns 1, 2, 3 - Patient Names, HIC NO., Dates of Service (From - To). - The documentation requested for these columns is derived from the beneficiary's bill. Furnish the patient's name, health insurance claim number (social security number) and dates of service that correlate to the filed bad debt. (See PRM-1, §314 and 42 CFR 413.80.)

Column 4 - Indigency/Welfare Recipient. - If the patient included in column 1 has been deemed indigent, place a check in this column. If the patient in column 1 has a valid Medicaid number, also include this number in this column. See the criteria in PRM-1,chapter 3, §§312 and 322 and 42 CFR 413.80 for guidance on the billing requirements for indigent and welfare recipients.

Columns 5 & 6 - Date First Bill Sent to Beneficiary - Date Collection Efforts Ceased. - This information should be obtained from the provider's files and should correlate with the beneficiary name, Medicare ID, and dates of service shown in columns 1, 2, and 3 of this exhibit. The date in Column 6 represents the date that the unpaid account is deemed worthless, whereby all collection efforts, both internal and by outside entity, ceased and there is no likelihood of recovery of the unpaid account. (See CFR 413.89(f) and PRM-1, chapter 3, §§308, 310, and 314.)

Column 7 - Medicare Remittance Advice Dates. - Enter in this column the remittance advice dates that correlate with the beneficiary name and date of service shown in columns 1, 2, and 3 of this exhibit. This will enable the MAC to verify the authenticity of the Medicare patient and the related deductible and coinsurance amounts.

Columns 8 & 9 - Deductible - Coinsurance. - Record in these columns the beneficiary's unpaid deductible and coinsurance amounts that relate to covered services as instructed in this exhibit.

Column 10 - Total Medicare Bad Debts. - Enter on each line of this column the sum of the amounts in columns 8 and 9. Calculate the total bad debts by summing up the amounts on all lines of Column 10. This "total" should agree with the bad debts claimed in the cost report. Attach additional supporting schedules, if necessary, for recoveries of bad debts reimbursed in prior cost reporting period(s).

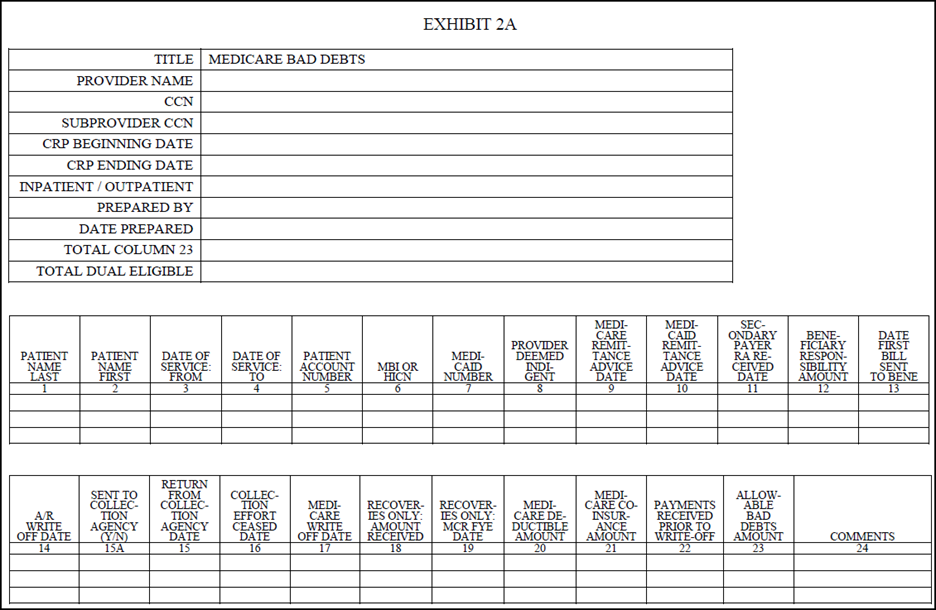

Exhibit 2a

Cost Reporting Periods on or after October 1, 2022

The provider should submit the Exhibit 2A, 2552-10 (Hospital) Exhibit 2A Medicare Bad Debt Specification. To expedite the review process, the provider may also want to consider submitting the state Medicaid remittance advices showing each uncollected co-insurance and deductible amount. Complete separate exhibits for bad debts resulting from inpatient services and outpatient services. A hospital healthcare complex claiming bad debts for multiple components must complete separate exhibits for each CCN. Enter dates in the MM/DD/YYYY format.

Columns 1, 2, 3, 4, 5, and 6 - From the Medicare beneficiary's bill, enter the beneficiary's name, dates of service, patient account or identification number, and MBI or HICN, that correlate to the claimed bad debt. (See 42 CFR 413.89(f).)

Column 7 - Enter the Medicare beneficiary's Medicaid number if the beneficiary was dually eligible (eligible for Medicare and some category of Medicaid benefits). If there is an entry in this column, there must be an entry in column 10.

Column 8 - Enter "Y" for yes if the Medicare beneficiary was not eligible for Medicaid but the provider deemed them to be indigent; otherwise, enter "N" for no. (See 42 CFR 413.89(e)(2)(ii).)

Column 9 - Enter the Medicare remittance advice date for the Medicare beneficiary information in columns 1 through 6.

Column 10 - Enter the Medicaid remittance advice date or, when the provider does not receive a Medicaid remittance advice, enter "AD" for alternate documentation used to determine state liability (42 CFR 413.89(e)(2)(iii)(B)), that corresponds to the Medicare beneficiary information in columns 1 through 7.

Column 11 - Enter the date a remittance advice was received from a secondary payer, if applicable. When a secondary payer does not accept liability, a denial or notification date may be entered.

Column 12 - Enter the amount of coinsurance and deductible for which the Medicare beneficiary is responsible. If the beneficiary is a qualified Medicare beneficiary (QMB), enter "QMB." For a Medicare beneficiary who is dually eligible for Medicaid (not a QMB), enter the amount the beneficiary is required to pay under the state cost sharing agreement (42 CFR 413.89(e)(2)(iii)). For a Medicare beneficiary deemed indigent by the provider (column 8 is "Y"), enter zero.

Column 13 - Enter the date that the first bill was sent to the Medicare beneficiary. If the beneficiary is a QMB, enter "QMB."

Column 14 - Enter the date the Medicare beneficiary's liability was written off of the accounts receivable (A/R) in the provider's financial accounting system. The date entered in this column may be the same as, or earlier than, the date the account was deemed worthless (written off as a Medicare bad debt).

Columns 15A and 15 - In column 15A, enter "Y" for yes if the account was sent to a collection agency; otherwise, enter "N" for no. If column 15A, is "Y", in column 15, enter the date the collection agency returned the account (i.e., the date that the collection agency ceased collection effort on the account).

Column 16 - Enter the date all collection efforts ceased, both internal and external, including efforts to collect from Medicaid and/or from a state for its cost sharing liability.

Column 17 - Enter the date the deductible and coinsurance amounts were written off as a Medicare bad debt (i.e., the amount must have been written off as a bad debt against the A/R in the provider's financial accounting system); all collection effort, internal and external, against the Medicare beneficiary and/or other third parties ceased; and a Medicaid remittance advice was received from the state for Medicaid patients or alternate documentation exists as permitted under 42 CFR 413.89(e)(2)(iii)(B).

Column 18 - Enter the amount of recoveries for amounts previously written off as an allowable Medicare bad debt in this or a prior cost reporting period. The amount reported in this column includes any payments received on an account after the account was written off as a bad debt, including payments received in the same year the account was written off when the payment was received after the date of the write off. (See 42 CFR 413.89(f).)

Column 19 - If an amount is reported in column 18, enter the fiscal year end of the cost reporting period in which the Medicare bad debt (to which the recovery applies) was claimed and reimbursed. This column is optional; however, the date assists in identifying recovery amounts that must be offset. The fiscal year end entered in this column is a prior cost reporting period unless the write-off and recovery both occurred during this cost reporting period.

Column 20 - Enter the Medicare deductible from the Medicare remittance advice (before any payments received from any party). Report deductible amounts only when the provider billed the patient with the expectation of payment. See 42 CFR 413.89(e)(2) for possible exception.

Column 21 - Enter the Medicare coinsurance amount from the Medicare remittance advice (before any payments received from any party). Report coinsurance amounts only when the provider billed the patient with the expectation of payment. See 42 CFR 413.89(e)(2) for possible exception.

Column 22 - Enter the amount of any payments received from the Medicare beneficiary, their estate, third party insurance, etc., before the account was written off, for any amounts reported in column 20 and/or column 21. For example, when a beneficiary had a liability from a prior year for a deductible of $2,500 and made payments totaling $1,500 in the prior and current years, the provider determined the remaining balance of $1,000 uncollectible and deemed worthless. The payments of $1,500 are reported in column 22, leaving the remaining $1,000 written off in the current period as an allowable bad debt.

Column 23 - Enter the allowable Medicare bad debt amount. This amount must be less than or equal to the sum of the amounts in columns 20 and 21, less any payments in columns 18 and 22. If the fiscal year end in column 19 is prior to this cost reporting period, enter the recovery amount (reported in column 18) as a negative amount in this column. For each CCN, the sum of the amounts entered in this column on each listing, (inpatient and outpatient), as applicable, must equal the bad debts claimed for that CCN on the Medicare cost report. For example, CCN ##-0001, an inpatient acute care hospital, reported bad debts of $24,000 on the Exhibit 2A for inpatient and indicated that $12,000 on the Exhibit 2A for Medicaid eligible. The amount reported on Worksheet E, Part A, line 64, must equal $24,000. The amount reported on Worksheet E, Part A, line 66, must equal $12,000 (dual eligible).

Column 24 - This column is for informational purposes. Enter any comments or additional information as needed.

Tentative Settlement Review

Medicare bad debts are reviewed during the tentative settlement process to ensure Medicare payment is not made on bad debts that may be disallowed and thus require that the paid funds be recouped.

Since bad debts can be pass-through costs, a bi-weekly pass-through payment may be established after the first cost reporting period in which the facility claims bad debts.

Noridian PARD management reserves the right to not establish a bi-weekly pass-through amount for facilities with bad debt amounts it determines to be immaterial.

Collection Efforts

To be considered a reasonable collection effort, a provider's effort to collect Medicare deductible and coinsurance amounts must be similar to the effort the provider puts forth to collect comparable amounts from non-Medicare patients. It must involve the issuance of a bill on or shortly after discharge or death of the beneficiary to the party responsible for the patient's personal financial obligations. It also includes other actions such as subsequent billings, collection letters and telephone calls or personal contacts with this party which constitute a genuine, rather than a token, collection effort. The provider's collection effort may include using or threatening to use court action to obtain payment.

Where a collection agency is used, Medicare expects the provider to refer all uncollected patient charges of like amount to the agency without regard to class of patient. The "like amount" requirement may include uncollected charges above a specified minimum amount. Therefore, if a provider refers to a collection agency its uncollected non-Medicare patient charges that in amount are comparable to the individual Medicare deductible and coinsurance amounts due the provider from its Medicare patient, Medicare requires the provider to also refer its uncollected Medicare deductible and coinsurance amounts to the collection agency.

CMS has provided clarification that debts referred to a collection agency are not considered uncollectible and may not be reimbursed until the bad debt is returned from the collection agency as uncollectible.

The provider's collection effort should be documented in the patient's file by copies of the bill(s), follow-up letters, reports of telephone and personal contact, etc.

If after reasonable and customary attempts to collect a bill, the debt remains unpaid more than 120 days from the date the first bill is mailed to the beneficiary, the debt may be deemed uncollectible.

Note: Any payment received on a bad debt restarts the 120-day period.

Indigent or Medically Indigent Patients

In some cases, the provider may have established before discharge, or within a reasonable time before the current admission, that the beneficiary is either indigent or medically indigent. Providers can deem Medicare beneficiaries indigent or medically indigent when such individuals have also been determined eligible for Medicaid as either categorically needy individuals or medically needy individuals, respectively. Otherwise, the provider should apply its customary methods for determining the indigence of patients to the case of the Medicare beneficiary under the following guidelines:

The provider, not the patient, must determine the patient's indigence; i.e., a patient's signed declaration of his inability to pay his medical bills cannot be considered proof of indigence;

The provider should take into account a patient's total resources, which would include, but are not limited to, an analysis of assets (only those convertible to cash, and unnecessary for the patient's daily living), liabilities, and income and expenses. In making this analysis the provider should take into account any extenuating circumstances that would affect the determination of the patient's indigence.

The provider must determine that no source other than the patient would be legally responsible for the patient's medical bill; e.g., Title XIX, local welfare agency and guardian.

The patient's file should contain documentation of the method by which indigence was determined in addition to all backup information to substantiate the determination.

Once indigence is determined and the provider concludes that there had been no improvement in the beneficiary's financial condition, the debt may be deemed uncollectible without applying the 120-day rule.

Please note that per PRM 15-1 §§328, charity, courtesy, and third-party allowances are not reimbursable Medicare costs. Charges related to services subject to these allowances should be recorded at the full amount charged to all patients and the allowances should be appropriately shown in a revenue reduction account.